What Can Our BI Solution Do for You?

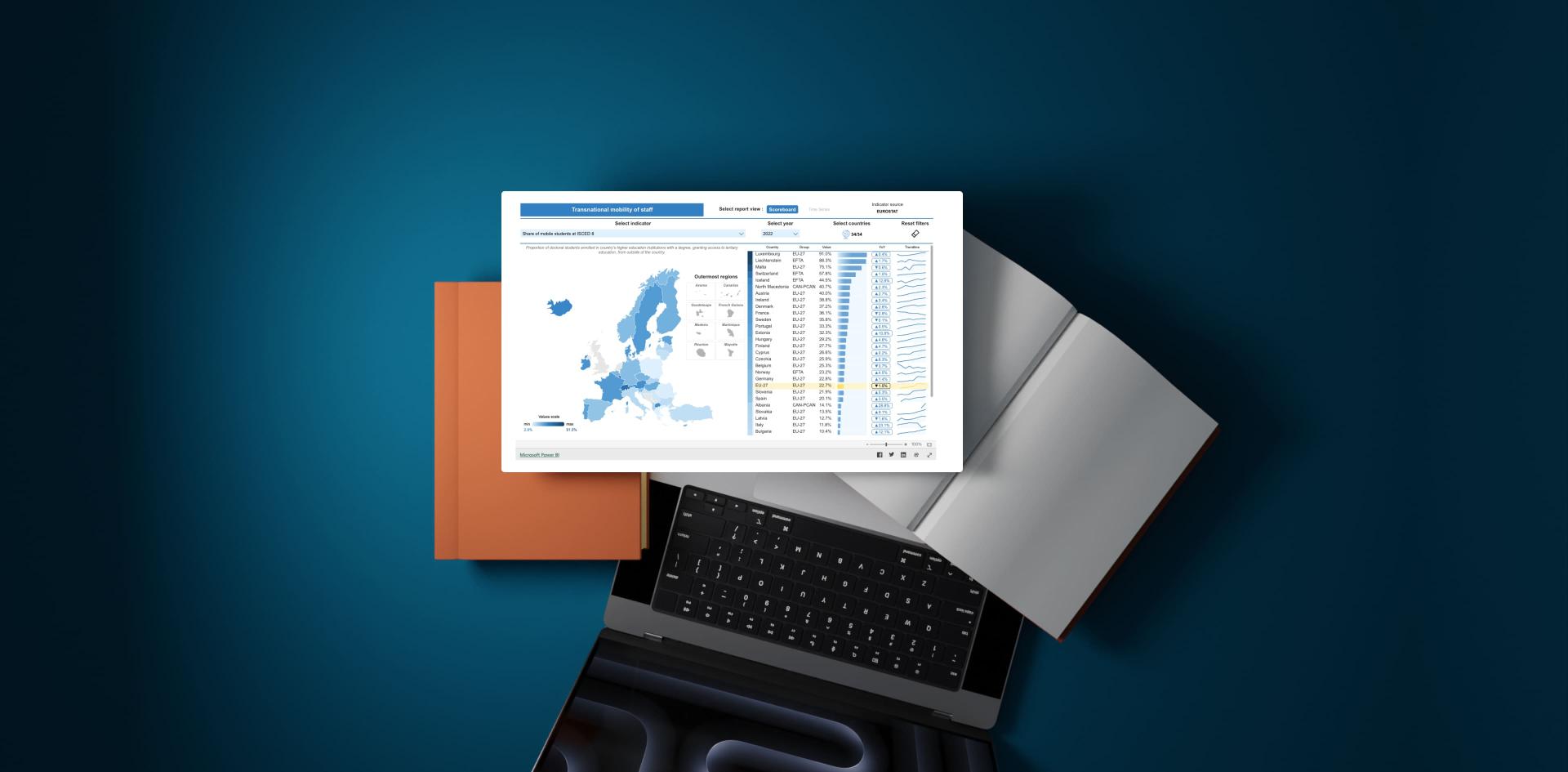

Smarter, Data-Driven Decisions

Make more confident decisions by accessing accurate, real-time data insights across your organization.

Increased Operational Efficiency

Automate data collection, reporting, and dashboarding - saving time and resources across departments.

Improved Financial Control

Gain full visibility into costs, cash flow, and financial health to improve profitability and reduce risks.

Better Goal Setting & Performance Tracking

Track KPIs with clear dashboards and align teams around measurable, impactful goals.

Discover New Business Opportunities

Spot trends, identify gaps, and stay ahead of competitors through advanced data analysis.

More Effective Strategy & Long-Term Planning

Build strategies backed by data, not guesswork - with full transparency into what’s working and why.

Excel vs. Business Intelligence

Our BI Solution

- Real-time data for faster decisions

- Integrated view across all sources

- Integrated view across all sources

- Predictive analytics for future planning

- Interactive dashboards with deeper insights

Excel

- Static snapshots of past performance

- Manual inputs, fragmented systems

- Time-consuming, error-prone manual reports

- Focuses only on historical data

- Limited interactivity and flexibility